Buyer’s Agent Service

With our exclusive AI-driven insights, discover Australian property hotspots before they boom — giving you the edge to invest early and stay ahead of the market.

Buying a property can be confusing — there’s so much information, and it’s easy to worry about missing out or making the wrong call. If you’ve ever had a bad buying experience, you know how tricky it can be when you don’t fully understand the local market.

Some areas may look affordable but don’t actually have growth potential, while flashy projects might be hiding real issues.

With our smart AI data insights, you can see the market clearly and spot opportunities early. We’ll guide you step by step and craft an investment plan that fits you. With the power of technology on your side, every decision you make has the potential to deliver stronger results.

Limited spots, book early to secure your place.

-

Use data science to capture assets that outpersform

-

Access to non-public intel for earlly strategic entry

-

Use AI tool to buy the right place at the right time

-

No longer rely on guess and noise information

When it comes to finding great property investments, have you ever felt this way?

You’re working hard, climbing your career ladder, and trying to squeeze in time to learn about property investment — but everything feels complicated and messy. There’s too much noise, too many opinions, and no clear starting point.

Between online courses, market reports, and advice from friends, it’s hard to tell who’s actually right. You just want someone to show you a clear, reliable path forward.

You’ve always believed in making decisions based on logic and data — yet past experiences might’ve taught you that buying with intuition or word-of-mouth tips can be dangerous.

Maybe you’ve owned properties that never brought the return you expected, or even became a financial burden. You can’t help but ask yourself: Was that really a smart buy?

Everyone talks about “asset allocation” and “long-term portfolios,” but what do those actually mean in practice? How do you find the right balance between safety and growth?

And perhaps the most frustrating part — by the time you hear about a good opportunity, it’s often too late. The best timing is gone, and others have already taken the lead.

Limited spots, book early to secure your place.

In an age of overwhelming information, no one can master it all.

True wisdom lies in knowing when to seek expert guidance.

Our AI-powered buyer’s agency service combines data, insight, and experience to help investors navigate the Australian property market with clarity and confidence.

Powered by our proprietary unique system, we transform complex data into actionable intelligence — identifying the suburbs and properties with genuine growth potential, long before they appear on public radar. From the first property search to final settlement, our dedicated team ensures every step is handled with precision and care, so you can invest stress-free and focus on results.

Over the years, we’ve guided hundreds of clients toward success stories like this one:

In 2016, a buyer purchased a luxury two-bedroom apartment in Sydney for $900,000. Everything looked ideal — close to the station, two stops from the CBD, surrounded by shops and cafes, near major employers like Qantas, and in high rental demand from UNSW students. Yet by 2024, despite record inflation and a booming national market, the property remained valued at roughly $900,000 — a costly stagnation.

Meanwhile, another investor who bought a $400,000 property in one of our AI-identified “Green Light Zones” saw it rise to $1.2 million — a 300% increase that outperformed both inflation and the wider market.

The difference isn’t luck — it’s data-driven insight.

See how your investment journey can transform with our expert support!

Before Working with Us

Busy with your career, trying hard to squeeze in time to learn property investment — yet it always feels out of reach. Faced with endless and scattered information, it’s hard to know where to start.

Online investment courses, market analysis, and friends’ suggestions only make things more confusing, leaving you without a clear and trustworthy direction.

You understand that good investments require solid data and logic, but past experiences have shown that relying on intuition or word-of-mouth can be risky and costly.

Some properties you’ve held for years haven’t delivered the returns you hoped for — instead, they’ve become a heavy mortgage burden, making you question your past decisions.

You want to build a long-term, diversified investment portfolio, yet you’re unsure how to balance risk and reward, or where to begin.

And time after time, it feels like you’re missing great opportunities — by the time you discover them, the best investment window has already closed.

After Getting Our Expert Support

You’ll finally stop feeling lost in the sea of property information — because we’ll show you only the projects that truly deserve your attention.

Our team scans over 15,000 Australian suburbs and pinpoints the “Green Light Zones” with the highest potential for explosive growth, helping you stay one step ahead.

With our in-house AI-powered System, your investment decisions become smarter, faster, and completely data-backed.

You’ll own quality properties that grow steadily over time — no more stress, no more heavy debt, just peace of mind and sustainable returns.

You’ll understand how to structure your portfolio and balance risk and reward to match your goals.

And from now on, you’ll be among the first to identify rising opportunities — investing early, with confidence, and without missing out again.

Limited spots, book early to secure your place.

Meet the Team

-

As a Chartered Financial Analyst (CFA) with 15 years of expertise in business consulting, I have advised 7 US-listed companies, 1 Australian-listed firm, and hundreds of small businesses. A seasoned property investor in Australia for over two decades, I pioneered a data- and AI-driven system in 2022 to guide investors in pinpointing the ideal locations at the optimal times. My mission is to empower Australians to sidestep costly financial pitfalls and build lasting wealth through the power of data science.

-

With a strong background in finance, lending strategy, and business leadership, I have spent years helping Australians structure smarter loans and build high-growth property portfolios. As a licensed mortgage broker and experienced property investor, I specialise in designing lending solutions that maximise borrowing power, optimise cash flow, and align directly with long-term wealth goals.

Alongside my work in lending, I have built and managed multiple successful businesses across Australia, giving me a uniquely practical perspective on investment execution, risk management, and financial strategy.

My mission is simple: to help everyday Australians access the right finance, the right strategy, and the right properties — so they can accelerate their path toward financial freedom with clarity and confidence.

gives you an early advantage in Australia’s property market — helping even first-time investors confidently find high-potential assets.

The System — Our Game-Changer

Through years of refinement, our AI model has grown from 30 core algorithms to 107 proprietary indicators, analysing both public and exclusive off-market data across more than 15,000 suburbs nationwide. The result: a clear and data-backed classification of every area into Green Light (High-growth), Yellow Light (Neutral), and Red Light (Risky) zones.

This system empowers our clients to enter rising markets early, position strategically, and achieve outstanding capital growth ahead of the curve. Once we identify the right area, we curate and negotiate the ideal properties for purchase — delivering end-to-end support all the way to settlement.

Think of it this way: Tesla’s true value isn’t just in its cars, but in its technology. Likewise, we’re more than a buyer’s agency — we’re a technology company powered by data and intelligence. Our greatest asset isn’t the property itself, but the insight that reveals where real growth begins.

Limited spots, book early to secure your place.

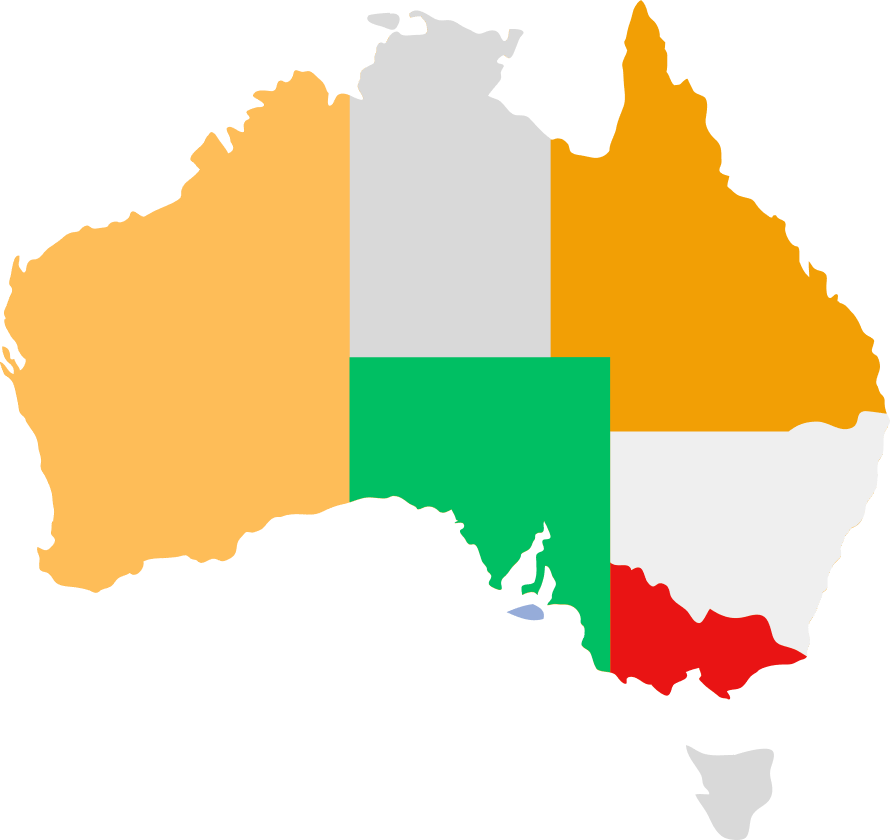

We Focus Exclusively on “Green Light Zones”

So What Exactly Are They?

Our AI-powered system scans the entire Australian property landscape and classifies over 15,000 suburbs into three categories: Green Light, Yellow Light, and Red Light Zones — not based on the past, but on the future.

Traditional data tells you where the market has been; our model predicts where it’s going next.

Green Light Zones: Suburbs expected to significantly outperform the national market within the next 12–18 months.

Yellow Light Zones: Areas likely to track with average market performance.

Red Light Zones: Markets that may underperform or decline in value.

These forecasts are derived from our 107 proprietary indicators combined with off-market intelligence, forming the backbone of our exclusive intellectual property.

Guided by this data, we work hand in hand with our clients to find, evaluate, and purchase properties exclusively in Green Light Zones — helping them stay ahead of the curve and capture the market’s next wave of growth.

Buying Is Easy — Having the Right Investment Strategy Is What Truly Matters!

Buying a property may seem simple — after all, real estate agents are selling everywhere. But does the property you buy really lead you to financial freedom?

Many investors purchased apartments or off-the-plan projects. I’ve done the same myself. Apartments can certainly have their advantages — such as higher depreciation deductions, negative gearing benefits, lower maintenance costs, and solid rental yields.

But here’s the key question: is an apartment the right investment for you?

The answer lies entirely in your investment strategy.

More than 90% of our clients invest for capital growth, while only about 10% focus on long-term cash flow for retirement. If your goal is capital appreciation, yet you choose to buy an apartment as a long-term investment, you may regret it ten years later.

In that case, the issue isn’t the property itself — it’s the strategy. Perhaps you’re not yet at the stage where an apartment suits your portfolio, or you may have used the wrong financial leverage for your current situation.

Limited spots, book early to secure your place.

a guided strategy

is what investsors lack to outperform the market

Even if you bought a detached house, the wrong timing, location, or property type can still cost you years of missed opportunity and delay your financial goals. Many investors rely on intuition or past experience, but without a structured, data-backed approach, it’s easy to drift off course and lose motivation.

That’s why we place such strong emphasis on investment strategy. Our first step is always to help each client develop a clear, personalised investment plan. This plan directly shapes your passive income, retirement age, estate planning, savings goals, borrowing strategy, asset structure, and ultimately, the returns you can achieve through property.

With the right strategy in place, buying the property becomes the second step — not the first.

We also help you understand the twin forces that truly define property success: the power of compounding and the impact of inflation. Mastering these two principles allows you to make smarter, long-term decisions that build wealth steadily and sustainably.

Limited spots, book early to secure your place.

Your Property Journey Doesn’t End with Finding the Right Home — It Begins with Securing the Right Finance

Buying the right property is only half the story. The other half is to structure your finance strategically — to maximise your borrowing power, minimise your costs, and accelerate your path to financial freedom.

At Clap Mortgages, our in-house loan specialists work hand-in-hand with our buyer’s agency team to provide integrated property + finance solutions tailored to your goals. Whether you’re a first-time buyer or a seasoned investor, we help you secure the right loan structure to complement your investment strategy.

Mortgage Solutions

by Clap Mortgages

Our Services

-

tailored solutions for owner-occupiers and investors.

-

strategies to manage cash flow, reduce interest, and protect your borrowing capacity.

-

unlock your property’s value for new investments or better rates.

-

specialist guidance for business and self-managed super fund borrowers.

-

we liaise directly with lenders so you can act fast when opportunity arises.

Client Success

-

Entry price: $300,000

Rental Yield: 7.1%

Deposit: $60,000

Greenlight Time: Jan 2022

Re-valuation: July 2022

Re-valuation result: $378,000

Capital Gain: $78,000 (26%)

ROI: 130%

-

Entry price: $610,000

Rental Yield: 8.9%

Deposit: $123,000

Greenlight Time: Nov 2020

Re-valuation: Mar 2021

Re-valuation result: $800,000

Capital Gain: $185,000 (30%)

ROI: 150%

-

Entry price: $490,000

Rental Yield: 6.2%

Deposit: $70,000 + LMI

Greenlight Time: Jun 2022

Re-valuation: Sep 2022

Re-valuation result: $560,000

Capital Gain: $70,000 (14%)

ROI: 100%

-

Entry price: $465,000

Rental Yield: 7.1%

Deposit: $93,000

Greenlight Time: May 2022

Re-valuation: Jan 2023

Re-valuation result: $545,000

Capital Gain: $80,000 (17%)

ROI: 86%

Limited spots, book early to secure your place.

Join us today

get expert guidance and start turning your property dreams into reality.

Whether you’re just beginning your investment journey or already an experienced investor, PeakPulse provides tailored strategies and professional support to help you succeed. We believe everyone deserves the opportunity to achieve financial freedom — and our mission is to help you make it a reality.

Here’s the incredible value you’ll gain with us:

• A complete analysis of your current investment position — plus personalized, expert advice and guidance, all free of charge. We’ll also help you uncover hidden opportunities and sharpen your investment mindset and decision-making skills — at no cost to you.

• You’ll see exactly how our Wushuang System uses 107 rigorous data indicators to pinpoint the “Green Light Zones” — suburbs with the highest growth potential. This allows us to allocate your capital strategically and achieve long-term, steady profits.

• You’ll gain a deeper understanding of how the Wushuang System works — and how this groundbreaking, data-driven strategy enables our clients to secure high-quality properties in a fraction of the usual time.

• You’ll also discover how our clients leverage forward-looking indicators to identify market trends early and use trend-based investing to consistently outperform the broader market.

Set up a complimentary chat

Ready to take the next step in your investing journey? Book an appointment with our friendly experts who are eager to offer tailored advice and help you make the most informed decisions for your future.

Contact Us

Interested in working together? Fill out some info and we will be in touch shortly. We can’t wait to hear from you!