Inflation Is Quietly Freezing Your Wealth and Here’s Why Most Investors Feel Stuck

Let me ask you something important.

Do you ever feel like you’re investing, but somehow your money isn’t really moving forward?

You save.

You invest.

You stay disciplined.

Yet every year, the cost of living rises faster than your returns.

That’s not bad luck.

That’s high inflation quietly eroding your real wealth.

The Trap Many Investors Are Stuck In

Here’s what’s happening to many investors today:

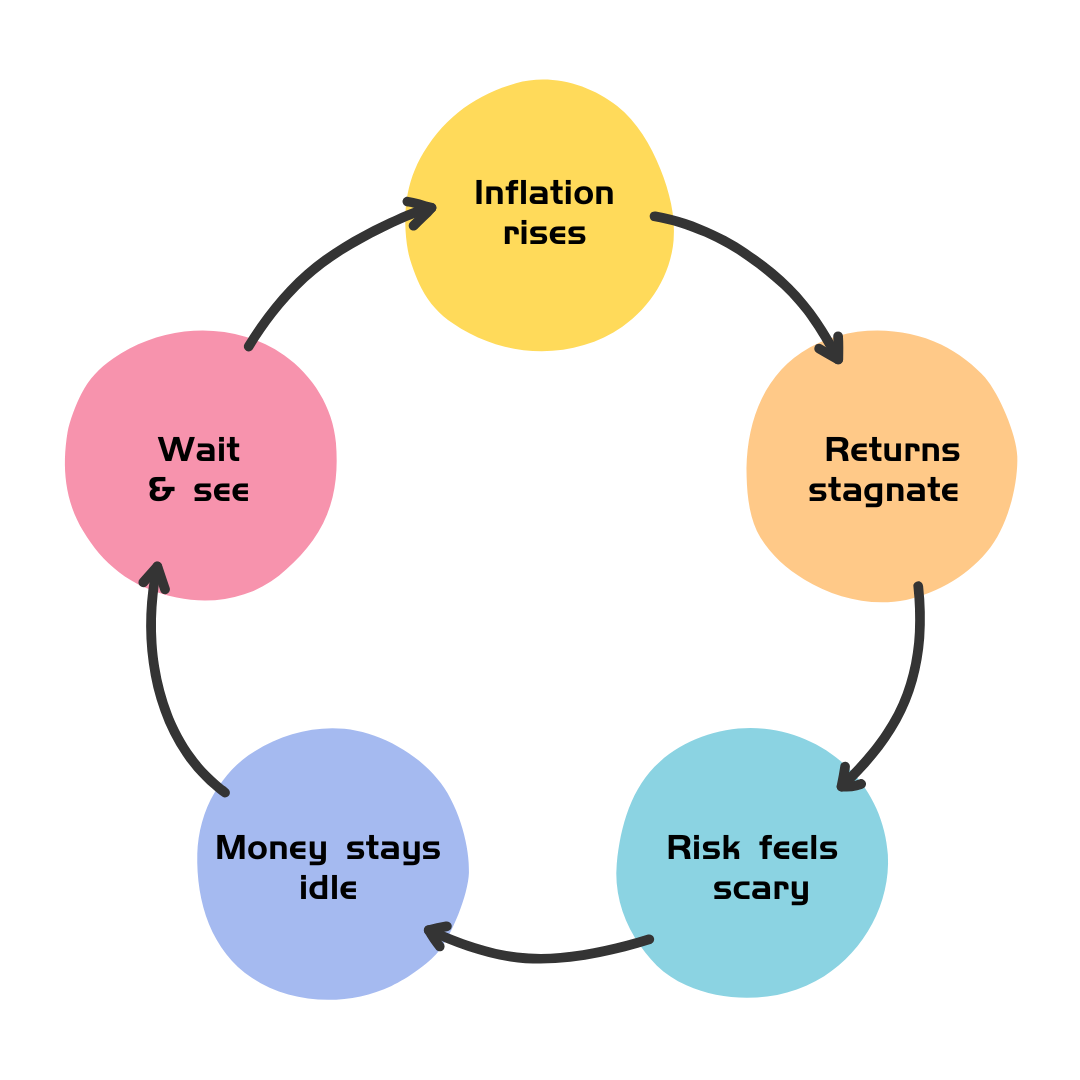

Cash loses purchasing power every year

Conservative investments fail to beat inflation

Riskier assets feel increasingly volatile

Waiting “for the right time” becomes permanent inaction

This creates a dangerous loop:

It’s not that you don’t want to grow your wealth.

It’s that the usual options don’t feel safe or effective anymore.

Why Inflation Hurts More Than You Think

Inflation doesn’t just make things more expensive.

It shrinks your future buying power, devalues savings silently, punishes investors who stay “on the sidelines”, and rewards assets that can pass inflation forward.

That’s why many experienced investors eventually realize:

“Doing nothing is no longer the low-risk option.”

Where Many Investors Start Looking Next

When people become aware of this problem, they usually begin asking better questions:

How do some investors stay ahead of inflation long-term?

Why do certain assets seem to benefit from inflation?

How do leverage and debt work for investors instead of against them?

Why does property keep showing up in serious portfolios?

This is often where Australian real estate enters the conversation.

Not as speculation.

Not as a quick win.

But as a structural hedge against inflation, when done correctly.

The Missing Piece Most People Don’t See

Property alone isn’t the answer.

How you buy? How you finance? How your mortgage is structured?

These factors often matter more than the property itself.

Many investors sense that property could help them escape stagnation but hesitate because they lack clarity, not interest.

And you may also worry about the rapid slump of the market such as what had happened in New Zealand and Canada.

A Smarter First Step

If inflation has made you feel stuck, uncertain, or cautious, you’re not behind.

You’re simply problem aware.

The next step isn’t rushing into a purchase.

It’s understanding how property and financing can be structured as a long-term strategy, especially within the Australian market.

If you’d like to explore that, calmly, clearly, and without pressure, we’re happy to help.

[Book a Private Strategy Conversation]

[Request Our Australian Property & Mortgage Overview]

Even clarity alone can change how you invest going forward.

Best regards,

The Peak Pulse Team